Southeast Asia Special Briefing on US Tariff Deals & its Outlook

Navigating the New Landscape

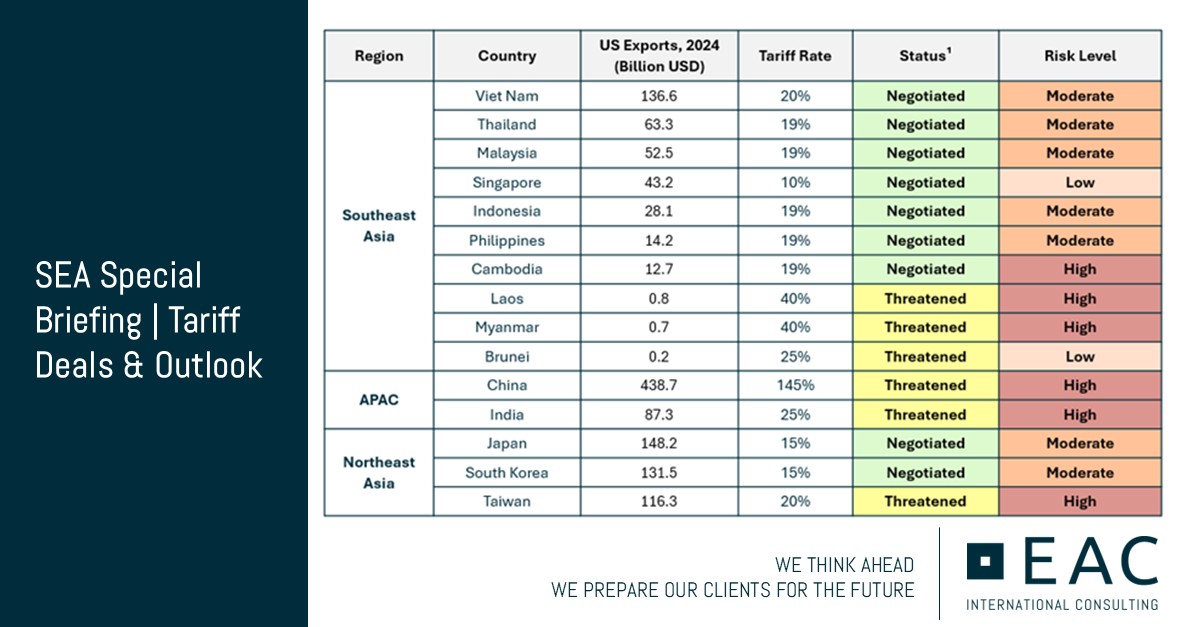

The August 1st deadline for the new US tariff regime has elapsed, leaving a varied landscape of outcomes across Asia. While some countries faced higher-than-expected rates, others, particularly within Southeast Asia, secured favorable accords. The new regime, with its nuanced application and targeted concessions, is set to reshape regional trade dynamics and supply chains. This briefing provides a detailed recap of the trade settlements, their implications for key economies, and the broader outlook for trade in the region.

The image provided offers a clear snapshot of the tariff rates and risk levels across various Asian nations. It highlights the successful negotiations of several Southeast Asian economies, which have managed to secure competitive tariff rates. Key economies like Malaysia, Thailand, Vietnam, and the Philippines will be relieved to see similar rates, which helps to level the playing field for competition, especially in the manufacturing sector.

- Singapore: The Exception with the Lowest Rate

Singapore stands out with the lowest tariff rate in the entire APAC region at just 10%. This is despite a trade deficit with the US and already maintaining zero tariffs on American imports. Given its role as a logistics and financial hub, Singapore’s direct exposure to these tariffs is minimal. However, the city-state has voiced concerns about the potential knock-on effects on regional investor sentiment and the broader trade ecosystem. The low tariff rate for Singapore reflects its strong economic ties and strategic importance to the US, solidifying its position as a key partner in the region. - Vietnam: Proactive Engagement Pays Off

Vietnam, a major US trading partner with exports valued at $136.6 bln in 2024, successfully reduced its tariff rate from an initial 46% down to 20%. This significant reduction was the result of proactive engagement focused on protecting its key export sectors, including electronics, textiles, and furniture. Despite this success, Vietnamese exporters face ongoing pressure from price-sensitive buyers in high-volume sectors. In exchange for the tariff reduction, Vietnam has opened its market to US goods, with the US stating it now faces zero tariffs when exporting to the country. - Cambodia: A Surprising Reduction

Cambodia’s journey through negotiations was particularly notable. Initially expected to land at a 36% tariff rate, the August 1st deadline saw a surprising further reduction to 19%. This places Cambodia on par with other major ASEAN economies and represents one of the largest global reductions. This success is likely due to Cambodia's significant trade deficit with the US, its reliance on American imports, and the potential severity of the impact on its less-established export manufacturing sector, particularly in footwear and textiles. The country's effective rate of 19% is a crucial win, providing a buffer against an expected 25-35% contraction in these sectors. - Malaysia & Indonesia: Aligning with the Region

Both Indonesia and Malaysia have secured tariff rates of 19%, putting them in line with other major ASEAN exporters. For Indonesia, this is a significant shift from the initial 32% rate. In return for these reductions, Indonesia has committed to significant procurement deals, including the purchase of Boeing aircraft, US energy products, and agricultural goods. Malaysia’s reduced rate is also a win, particularly for its high-value export sectors like semiconductors and pharmaceuticals, which will remain exempt from tariffs for now. This was a result of targeted negotiations and the government's proactive measures to address US concerns over sensitive tech exports. - The Philippines & Thailand: Modest but Meaningful Reductions The Philippines negotiated a modest reduction from 20% to 19%, offering some relief for its electronics sector. The deal also includes US pledges for maritime, energy, and economic development programs. Similarly, Thailand, despite enjoying a trade surplus with the US, managed to reduce its tariff rate from 36% to 19% just before the deadline. A key concession from both countries was the granting of zero-tariff access for US products, including cars for the Philippines and agricultural goods for Thailand.

The Left Behind: Laos and Myanmar

In stark contrast to their neighbors, Laos and Myanmar face the highest tariff rates in the region, each at 40%. Only Syria faces a higher tariff of 41%.

- Laos: As one of the region’s least-developed countries, Laos has limited capacity to absorb such a severe trade shock. Its closely linked supply chains to China have contributed to the punitive rate. The garment industry, which represents a small portion of its GDP, is particularly at risk. Trade talks with other partners like Russia have been announced as the country seeks to pivot away from the US market.

- Myanmar: Already grappling with an economic crisis, Myanmar was unable to officially negotiate due to the US non-recognition of its military rulers. The new tariff is expected to primarily impact the garment industry, which is a major employer of women and has a high proportion of Chinese investors. However, given that Myanmar's primary trading partners are Thailand, China, and Japan, the short-term impact of the new tariff may be relatively limited.

The Future Outlook: Continued Uncertainty and Competition

While the tariffs are generally lower than expected across Asia, the long-term effects will likely see a push for increased intra-regional trade and more aggressive competition for markets in the Middle East and Europe. The unpredictable nature of the current US administration and the potential for product-specific tariffs mean that further negotiations and adjustments are not out of the question. Conversely, the potential for tariff rates to increase remains if countries are perceived as being retaliatory. The upcoming ASEAN Summit in Malaysia, with President Trump expected to attend, could provide a platform for further discussions. For now, countries that have received reduced tariffs are expected to uphold their commitments to opening up their economies to US goods and companies or face a swift revision of their trade deals. The new tariff regime, while offering some relief, signals a new era of trade relations where concessions and strategic alignments will be paramount.

Latest

The Johor-Singapore Special Economic Zone: Where Strategic Vision Meets Market Reality

EAC Hydrogen Series: The Pulse of the Global Hydrogen Economy

MNC Localization in China: Strategic Adaptation in a Changing Business Environment

NEW: 2025 EDITION-ASEAN INVESTMENT LOCATION COMPASS