Energizing the Future: India’s ACC landscape

Market Status Quo and Regulatory Scenario:

India's ACC market is expected to be valued at 19.5 bln EUR by 2025, growing at 10.6% from 17.6 bln EUR in 2024, primarily driven by increasing prospects of end-use applications and government initiatives.

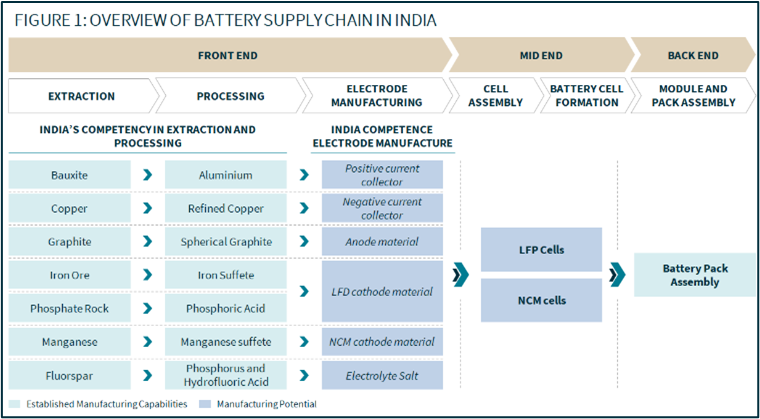

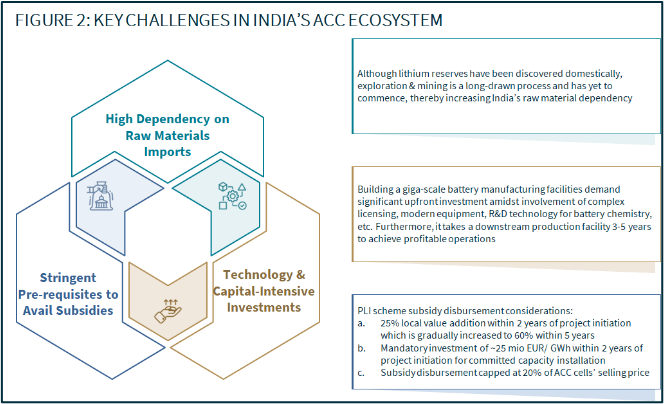

Though India has expertise in pack assembly and recycling, critical material processing and electrode manufacturing competencies remain limited. Consequently, India imports most raw materials, including lithium, cobalt, and nickel, from countries like China and Taiwan.

To address these supply chain gaps and strengthen the domestic manufacturing ecosystem, government has taken several initiatives including:

- Introduction of National Programme for ACC, supported by Production Linked Incentive (PLI) scheme with a budget of ~2 bln EUR aimed at installing 55 GWh ACC and niche ACC capacities

- Waiver of custom duties on import of essential minerals including Lithium, Cobalt and Nickel

These initiatives have attracted significant investments. Indian companies such as Reliance, Ola Electric, and Rajesh Exports have committed to install 40 GWh of ACC capacities. Furthermore, International companies such as IBC, CATL, and Panasonic are planning to set-up production facilities in India.

Outlook & Way Forward:

China currently accounts more than 80% of the world’s battery manufacturing value chain; with China facing geopolitical turmoil, companies globally are seeking to diversify their production centres to other countries with India being viewed as a viable alternative. Although India’s battery manufacturing competencies are at a nascent stage, Indian companies have exhibited expertise in mineral processing, cell production, pack assembly and battery recycling.

Thus, India could become a notable producer of certain goods in the global battery supply chain by positioning itself as:

- Supply base for exporting raw materials and precursor materials

- Production hub for Black Mass and Battery Recycling

- Suitable partner for joint overseas mineral exploration

EAC Support:

While the opportunities are lucrative, they have their own set of challenges. Whether it is assessing the localization feasibility or quantifying the addressable demand, deep knowledge of Indian market is an imperative to succeed. EAC International Consulting has extensive experience supporting multinational companies in navigating India’s market. We provide tailored market entry strategies for companies interested in entering the Indian ACC market. For an insightful discussion you may connect to EAC team members – Anup Barapatre or Anuj Saley for a consultation on this promising topic.

Latest

The Johor-Singapore Special Economic Zone: Where Strategic Vision Meets Market Reality

EAC Hydrogen Series: The Pulse of the Global Hydrogen Economy

MNC Localization in China: Strategic Adaptation in a Changing Business Environment

NEW: 2025 EDITION-ASEAN INVESTMENT LOCATION COMPASS