India’s Wind Sector at Scale: Infrastructure, Investment, and Industrialization

NIWE estimates India’s wind potential at over 1,100 GW, concentrated in Rajasthan, Gujarat, Maharashtra, and Tamil Nadu. While international turbine manufacturers have developed models producing up to 10 MW, most domestic turbines remain below 3 MW. Indian manufacturers are scaling up—Adani Wind, for example, has developed a 5.2 MW turbine, among the world’s largest onshore models

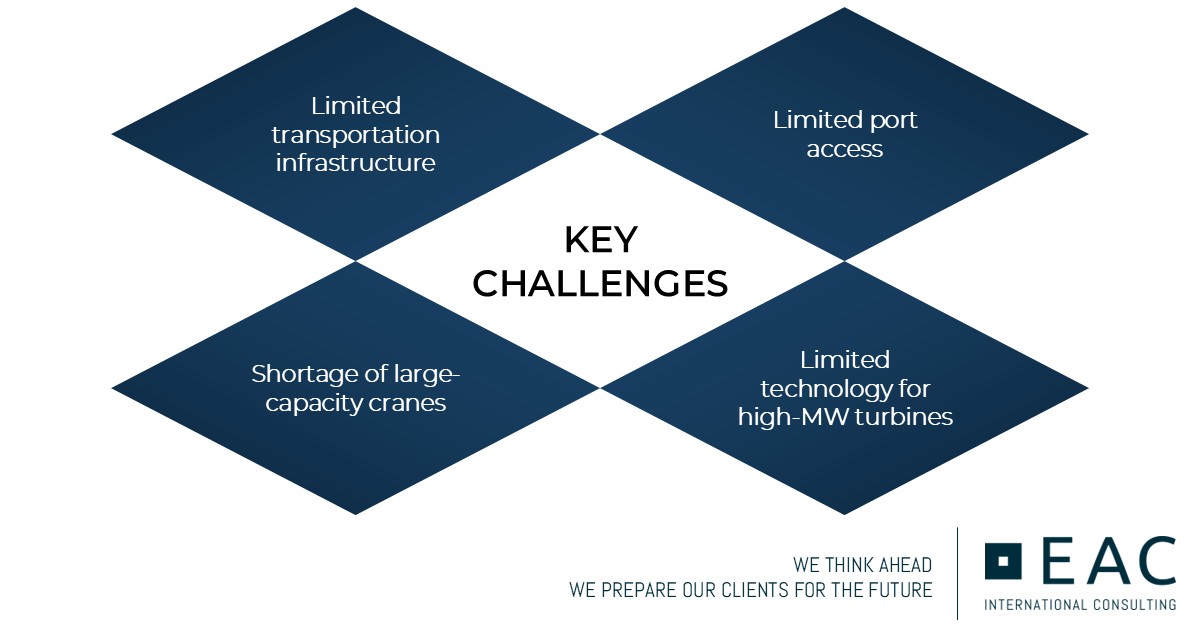

Four boxes with the key challenges listed above.

Challenges: Research and development spending is low compared to global standards, limiting technological progress among domestic manufacturers. For example, Suzlon invests less than 1% of its revenue in R&D, while international peers such as Vestas and Siemens Gamesa allocate between 3–4%. Land acquisition remains complex and time-consuming due to fragmented ownership patterns. In large-scale projects, this can extend to several hundred stakeholders—up to 500 landowners.

Grid integration remains a concern, particularly in high-potential but remote areas where transmission infrastructure is limited, and intermittent wind generation cannot be efficiently managed.

India’s wind energy sector is advancing despite existing challenges. The country has a strong domestic manufacturing base with an annual WTG production capacity of 15–18 GW with 70–80% of localization. Manufacturers are progressively adopting advanced technologies, exemplified by Adani Wind's 5.2 MW onshore turbine.

Infrastructure improvements further support this progress – particularly the road infrastructure which aims to ease movements of over-dimensional/ overweight cargo; for example, the Mumbai–Nagpur expressway has halved travel time from 16 to 8 hours, and the Mumbai–Delhi expressway targets to reduce travel time from ~24 to 12 hours upon its completion in 2026. These enhancements, featuring 6–8 lane highways, will facilitate the efficient transport of oversized/ heavy turbine components.

Port infrastructure is also being modernized under the Sagarmala Program, with over 230 port projects identified nationwide. Nearly 100 projects have already been completed, while dozens more are under implementation, including efforts to expand capacity at major ports and develop 14 new ports nationwide. These developments aim to improve cargo handling efficiency and support logistics for large-scale manufacturing and energy projects. Additionally, the Intra-State Transmission System (ISTS) Green Energy Corridor Phase-II is implemented in seven states—Gujarat, Himachal Pradesh, Karnataka, Kerala, Rajasthan, Tamil Nadu, and Uttar Pradesh. This initiative aims to establish approximately 10,750 circuit kilometers of transmission lines and 27.5 GVA substations to integrate around 20 GW of renewable energy capacity.

Over the past decades, Indian manufacturers have developed substantial technical expertise and are increasingly capable of producing larger turbines using advanced materials. These developments signal a gradual shift toward enhanced implementation capacity and improved logistics readiness in India's wind energy sector.

India offers a large and growing market for wind energy, supported by long-term government targets and substantial natural resources. States like Gujarat, Tamil Nadu, Rajasthan, and Maharashtra have consistently high wind speeds and are identified as key onshore and offshore development zones. The offshore wind potential in Gujarat and Tamil Nadu alone is over 70 GW.

Government support mechanisms—such as the Inter-State Transmission System (ISTS) charge exemption (extended to 2025), renewable purchase obligations (RPOs), and Viability Gap Funding (VGF) for offshore projects—are in place to attract investment and improve project bankability.

For international companies, India presents an opportunity to enter through joint ventures, technology partnerships, and local manufacturing collaborations. Combining an experienced domestic industry, cost-effective production, and access to a fast-growing regional market positions India as a potential manufacturing and export hub for wind turbines / components in the Indo-Pacific region.

Achieving 140 GW by 2030 will require progress in transmission, logistics, and high-capacity turbine production. With strong manufacturing, skilled workforce, and policy momentum, India is well-positioned to become a regional wind energy hub. India's wind energy sector presents long-term potential for global players through manufacturing partnerships, technology transfer, and local market development.

While structural challenges remain, India is building the infrastructure and policy framework to scale wind capacity and localize advanced technologies. With increasing pressure to reduce import dependence, particularly for critical components such as power electronics, control systems, and generator technologies, companies with relevant capabilities are well-positioned to enter the market and support this transition.

EAC International Consulting brings deep experience supporting multinational companies with market entry, strategy, localization and collaborations in complex industrial sectors. In recent engagements, EAC supported industrial automation and energy sector clients.

Get in touch

Our team of professionals, Rituraj Shailendra and Anup Barapatre, can be contacted for further discussion.

Latest

EAC Hydrogen Series: The Pulse of the Global Hydrogen Economy

MNC Localization in China: Strategic Adaptation in a Changing Business Environment

NEW: 2025 EDITION-ASEAN INVESTMENT LOCATION COMPASS

India’s Infra Push: Opportunity Zones in Tier-2/3 Cities