Outsourcing of non-core activities to developing Innovation hubs: The new Shared Services concept in practice

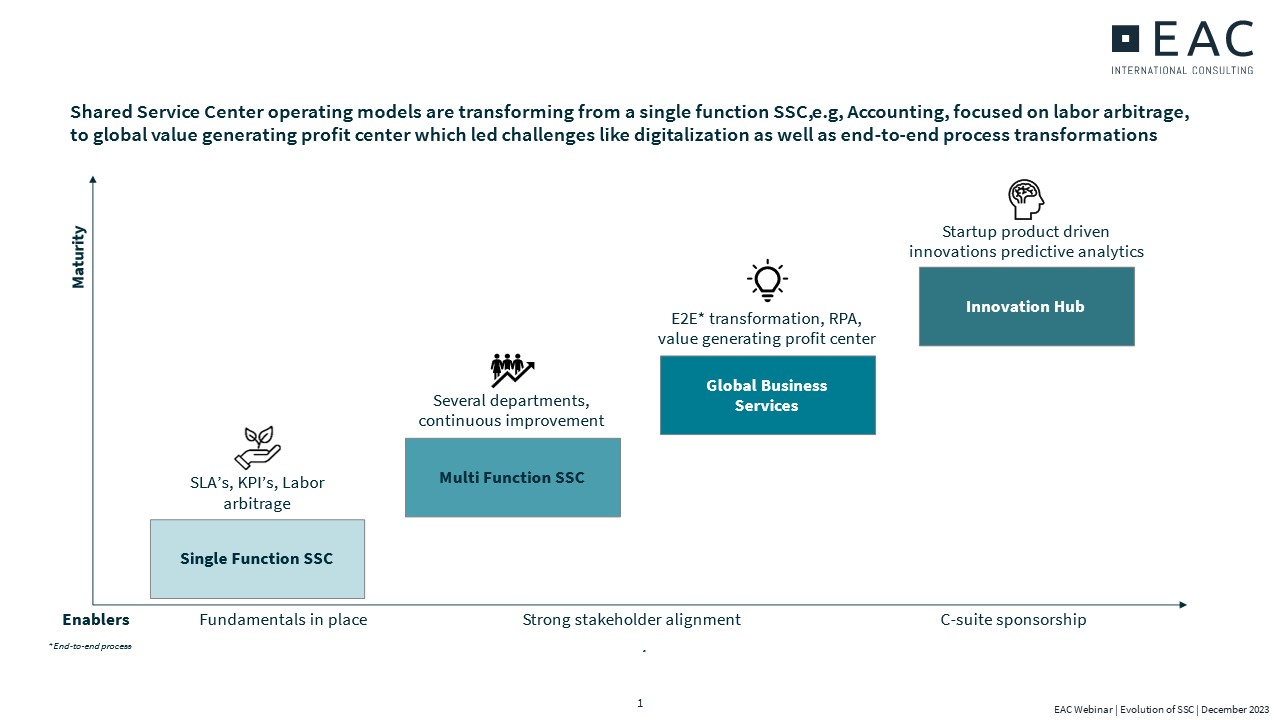

To focus on core business competencies without impeding the flow of non-core activities while achieving cost efficiencies, businesses have been setting up shared services centers (SSCs) since 1980s but over the years, the model has evolved to adapt better to changing business requirements.

From Shared Services Centers (SSC) to Global Competence Centers (GCC) and Global Business Services (GBS), service delivery model encompassing outsourcing, captive shared services as well as centers of excellence (COEs) for serving various business units have been the guiding pillars to offer centralized expertise and support in specific business activities.

There is a marked movement towards more value-added activities being outsourced and many countries have surfaced as preferred shared services destinations for a specific set of activities. For example, India which has traditionally been known as an IT service outsourcing destination is now also the hub for centralized design hubs not only catering to customers in the country but also to players around the globe.

Two of the major players pushing the global envelope are India and Malaysia. By 2030, India’s GCC market is expected to reach a valuation of ~90 bln EUR with 2,500 GCCs. Banking on its large and technically skilled labor market, India offers a wide range of services including traditional SCCs, specialized GCCs including CRM, global sourcing centers, engineering R&D as well as contract manufacturing at highly competitive prices. Malaysia on the other hand, is currently home to 31 Data Centers, 75 Cyber centers, and 23 Digital Hubs. The industry employs about 250,000 people which the government aims to increase to 500,000 by 2025 and is actively running training and incentives programs across the country.

Further west, Central Eastern Europe is preferred for near-shoring by European companies with Poland leading the market with ~1,700 SSCs, followed by Czech Republic and Hungary with ~600 SSCs collectively. Together, these three countries focus on finance, IT and HR activities while Poland is also the key SSC hub for automotive tier suppliers.

Identifying the correct model and best-fit location requires a clear understanding of business targets and a step-by-step mapping to the value process and the quantification of impact that can be ascertained over an investment requiring support from experienced personnel at EAC with Uwe Haizmann, Anna Ahlborn, Karl Godderis and Rituraj Shailendra

Latest

India’s Wind Sector at Scale: Infrastructure, Investment, and Industrialization

Elevated Experiences, Broader Appeal: India’s Premiumization Trend

BUILDING THE FUTURE IN ASEAN

Seizing India’s Industrial Automation Boom: A Strategic Opportunity for Global Players