Sourcing in Southeast Asia: Diversifying your Supply Chain to Gain More Resilience

Unexpected Circumstances Result in Supply Chain Disruptions

With the daily number of confirmed Covid-19 cases continuing to reach record highs, China’s financial mega-city, Shanghai, is being imposed to observe total lock-down since the end of March, resulting in shortage of transport and port workers.

By beginning of April, the number of ships waiting for loading and discharge at Shanghai port reached 300+, tripling usual volume. As the largest export hub of China, consequence of congestion at Shanghai port is expected to impact in the next few months.

Looking back at major inflictions on global supply chain in last few years, including China-US trade war, Covid-19 pandemic outbreak, earthquakes in Japan automotive electronics cluster, and the recent Russia-Ukraine war, many firms have come to realize that relying too much on any one country for critical supplies brings high risk of dependency.

A diversified supply chain helps to minimize disruptions that stem from natural disasters, geopolitical events, or other unforeseen circumstances.

Southeast Asia’s Rise as An Emerging Export Hub Beyond China

Benefitting from trade war and rising wages in China, economies in Southeast Asia have been boosting their export business especially for manufactured goods in recent years. With the recovery of global market demand in 2021, Southeast Asian economies’ export volume soared as the landscape of qualified suppliers saw drastic improvement:

- Vietnam: exported USD 300 billion, up 17.5% YOY; manufactured goods accounted for 89%, up 18% YOY; amongst telephones, mobile phones and parts thereof (21%), textiles (12%), computers and electrical products (12%), shoes and footwear (7%), and machinery, instruments, and accessories (6%)

- Malaysia: exported USD 283 billion, up 26% YOY; amongst electrical and electronics products (36%), chemicals (7%), petroleum products (7%), liquefied natural gas (6%), and palm oil (5%)

- Thailand: achieved USD 271 billion, up 17.1% YOY; manufactured goods accounted for 86%, incl. electronics (14%), automobile (13%), machinery and equipment (7.5%), and foodstuffs (7.5%)

- Indonesia: reached USD 232 billion, up 42% YOY, breaking the previous record of US $203.5 billion in 2011; main manufactured exports are minerals, crude palm oil and its derivatives, steel, electrical and electronic products, automobile and components

Improving Supply Chain Resilience via Diversification

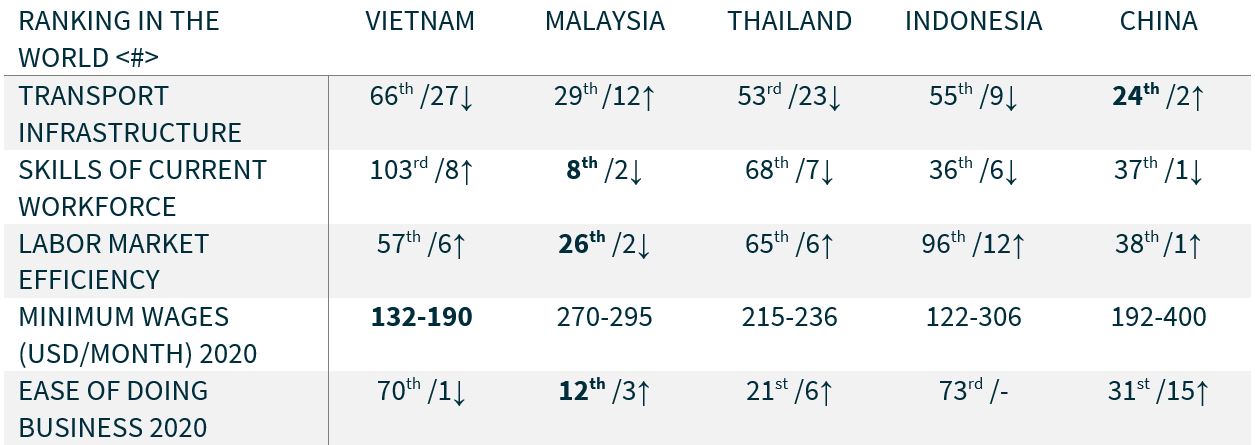

The need for building a more resilient supply chain during volatile times helped put Southeast Asia in the spotlight again. Countries such as Vietnam, Thailand, Malaysia, and Indonesia improved tremendously in terms of quality, capacity, delivery, cost, and responsiveness to overseas demand.

Notably, Malaysia is overtaking China on business environment and labor market efficiency, according to competitiveness index from World Bank. Thus, decision-makers within multinational enterprises are re-assessing the resilience of their global supply chain and are reconsidering and investigating Southeast Asia for alternative supply opportunities.

Optimistic and Confident in 2022 Economy Forecast

Despite countries in Southeast Asia currently experiencing a resurgence of infection by the Omicron variant, symptoms are reportedly much milder, and the respective governments are showing strong confidence and determination to continued economic development and recovery in 2022.

- Vietnam: in the Socioeconomic Development Plan 2022, the National Assembly (NA) set the economic growth target of Vietnam in 2022 at 6-6.5%. To achieve this growth target, the government places a focus on infrastructure development and aims to ensure that disbursement rate of public investment exceed 90% for this year.

- Malaysia: the economy is expected to grow by 6% in 2022, mainly driven by sustained rebound in domestic demand, as economic and social activities continue to recover despite ongoing Omicron pandemic

- Thailand: Thailand’s economy recovered strongly in the fourth quarter of 2021, facilitated by robust exports and an easing of COVID-19 curbs. The Thai government is confident that the economy will grow 4% this year, as estimated by several domestic and foreign agencies

- Indonesia: According to Bank Indonesia (BI), the economy is expected to grow at a faster pace of 4.7-5.4% in 2022. Despite the turmoil caused by COVID-19 variants, overall business sentiment in Indonesia has remained positive, with the support of stimulus policies and improvements in global and domestic economies

German SME’s Sourcing Diversification Practice: 1st Southeast Asia Purchasing Initiative

More and more manufacturing MNCs and SMEs have now started to take additional actions to diversify supply chains especially in SEA. For example, the Federal Ministry of Economics and Climate Protection (BMWK) and Germany Trade and Invest (GTAI) launched their 1st Southeast Asia Purchasing Initiative on March 9, 2022.

Their aim is to showcase the supply capabilities of SEA to German companies. As a result, more than 250 meetings were conducted with selected suppliers from Vietnam, Malaysia, Thailand and Laos for discussion of purchasing opportunities over a wide range of production materials including metal, castings, plastics and electronic components.