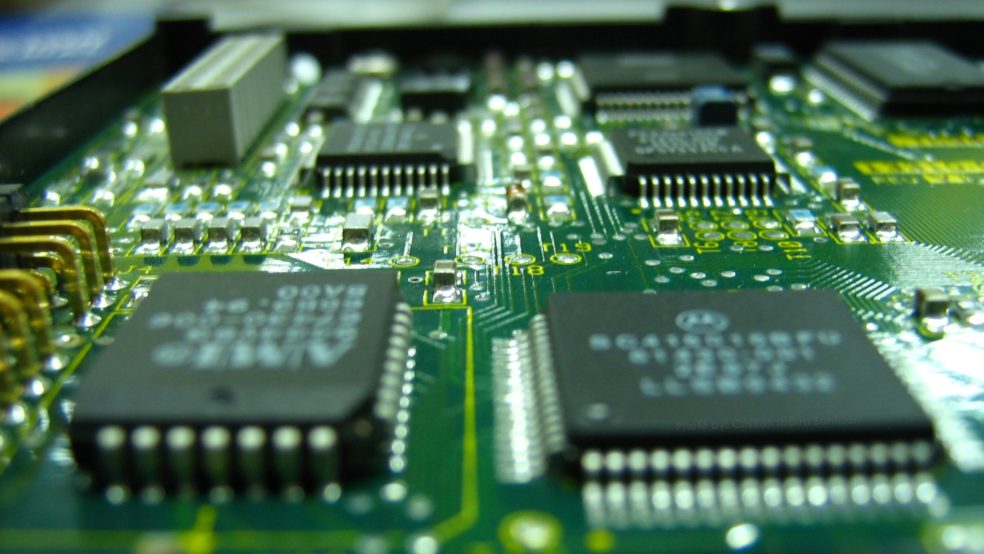

US Semiconductor Ban on China & Implications for International Companies in China

US’s further moves to contain China’s semiconductor industry

In early October 2022, the US issued nine new rules, detailing export controls on advanced chips, transactions for supercomputer centers, and transactions involving certain companies on the Entity List. In addition, these new rules also impose new controls on certain semiconductor manufacturing equipment and on transactions for certain integrated circuit end uses. In a further restriction, US citizens and green-card holders will also be banned from working on certain technologies for Chinese companies and entities.

The impact is spreading

The new US controls are finely calibrated and applied on most leading-edge chips, involving “Logic integrated circuits using a non-planar transistor architecture or with a “production” technology node of 16/14 nanometers or less”, “NOT AND (NAND) memory integrated circuits with 128 layers or more” and “Dynamic random-access memory (DRAM) integrated circuits using a ‘production’ technology node of 18 nanometer half-pitch or less”, which power smartphones, supercomputers, autonomous vehicles, medical imaging, drug discovery, climate modelling, artificial intelligence systems and much else. The ruling intends to lock up design and manufacturing capabilities of China’s advanced chips from people, equipment, parts and materials perspectives. Immediate effects are:

- According to expert opinions, China’s own equipment makers remain four to five years behind their overseas counterparts, making them unsuitable as instant substitutes for equipment lost from US suppliers such as KLA Corp, Applied Materials and Lam Research. Therefore, current production capacity of advanced chips can no longer be guaranteed.

- In the US, semiconductor companies, counting China as their largest single market, are facing potentially severe damage to their revenues. Other companies that manufacture high-end products in China must recall US employees as banned in the regulations.

- Internationally, large chipmakers such as Taiwan’s TSMC, South Korea's Samsung as well as Netherlands-based ASML, which makes chip manufacturing equipment, are evaluating their business with China as they explore how deeply the new rules will cut into their sales.

Implications for MNC in China

By the new regulation, issued on 7th Oct. 2022, reducing economic and technological entanglement becomes inevitable between US and China. The new restriction may accelerate industry upgrading in China and bring broader market for high-end technology and products. It is suggested to keep close attention to semiconductor industry how China and the market will develop.

On the other hand, these unprecedented steps would create a less stable world where globalization lives on but is going through a transformation with limited free trade, increasing protectionist, accelerated technology race as well as potential high-tech embargo. MNCs in China are urged to re-balance and match their China strategy to prepare for de-risking but to stay in the game. Considering the importance of the Chinese market and its production capabilities, different China-specific scenarios with corresponding counter measures should be elaborated and deployed.

Latest

India’s Technical Textile Sector: Strategic Growth Outlook

The April tariff shockwave necessitates navigating the new trade landscape

India’s Wind Sector at Scale: Infrastructure, Investment, and Industrialization

Elevated Experiences, Broader Appeal: India’s Premiumization Trend