The Latest US Tariffs on Chinese Goods

Tariffs Targeting China Announced by the Biden Administration

The Biden administration has announced an increase in tariffs on USD 18 billion worth of Chinese imports. This action is part of a broader strategy to protect American industries and workers.

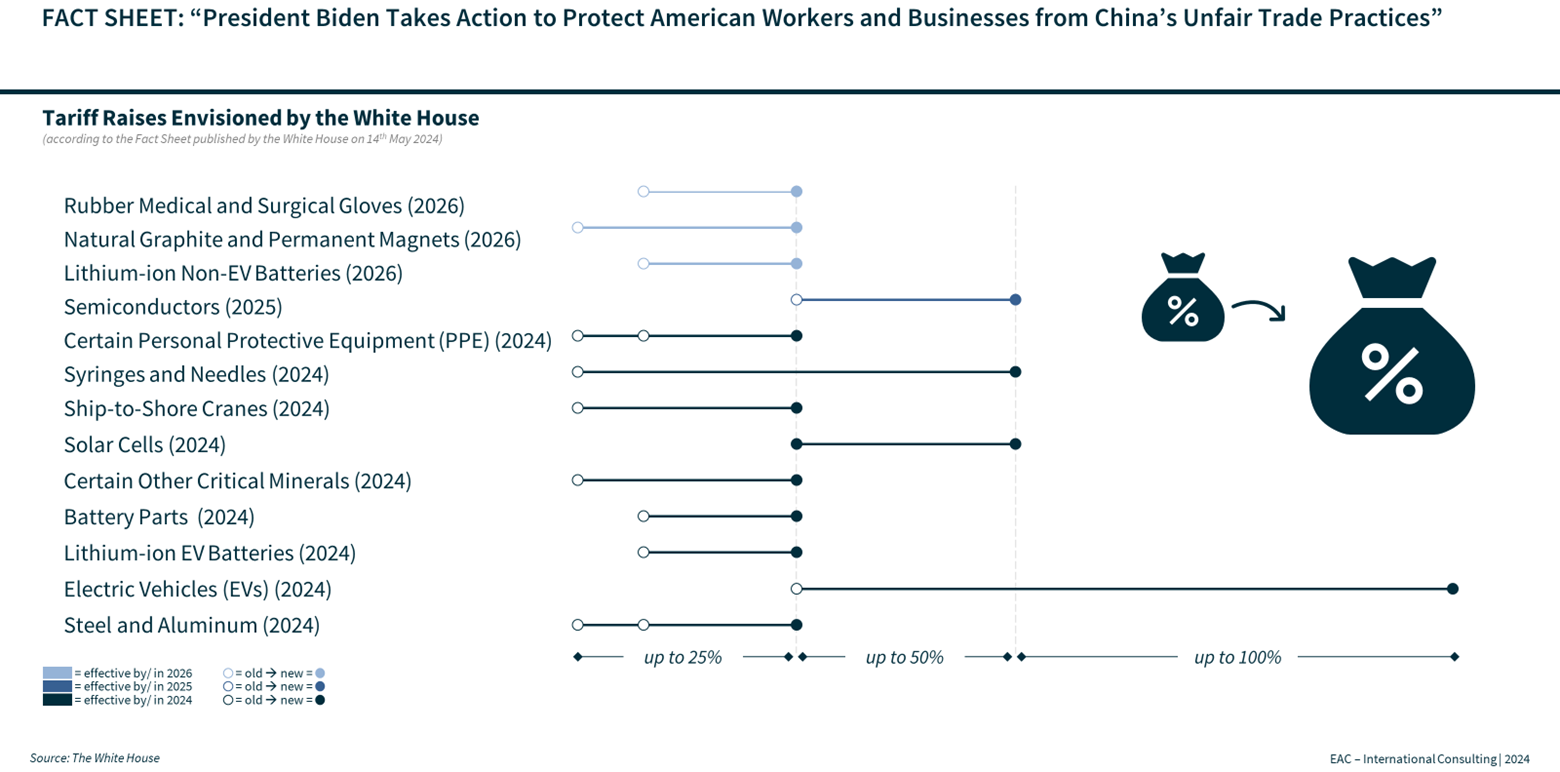

Tariff Increases Range from 25% to 100%

The new tariffs, ranging from 25% to 100%, target key industries and aim to shield American businesses from cheaper Chinese alternatives:

- Steel and Aluminum: The tariff rate on certain steel and aluminum products will increase to 25% in 2024. This measure is designed to support the US steel industry, which is leading the future of clean steel production, by countering China’s steel

- Semiconductors: The tariff on semiconductors will rise to 50% by 2025. This sector is critical for technological advancement and national security. The tariffs are intended to curb China’s market share growth and overcapacity in legacy semiconductor manufacturing

- Electric Vehicles (EVs): The tariff on EVs will jump to 100% in 2024. This increase is a protective measure for the burgeoning US EV industry, which is being supported by significant investments under the Investing in America agenda

- Batteries and Critical Minerals: The tariff on lithium-ion batteries, lithium-ion EV batteries, and related components will rise to 25%. This aims to reduce dependency on Chinese imports and strengthen the domestic battery supply chain

- Graphite, Permanent Magnets, and Other Critical Minerals: The tariff rate on natural graphite and permanent magnets will increase to 25% by 2026, with certain other critical minerals also seeing similar increases by 2024. This measure is designed to reduce dependency on Chinese imports and secure the supply chains for essential materials

- Solar Cells: The tariff on solar cells will increase to 50% by 2024. This measure targets China’s dominance in the global solar supply chain and supports US solar manufacturing

- Ship-to-Shore Cranes: The tariff rate on ship-to-shore cranes will increase to 25% in 2024. This action is intended to protect US manufacturers from ship-to-shore cranes imported from China, which have led to excessive market concentration

- Medical Products: Tariffs on medical supplies, such as syringes, needles, and Personal Protective Equipment (PPE), will increase to as much as 50% by 2024 and 2026. This move supports the US medical supply industry, which has been impacted by underpriced Chinese imports especially during COVID-19

Mixed Implications for Chinese and American Businesses, Consumers, and Economy

These tariff increases are expected to have a mixed impact on US and Chinese industries. While the tariffs aim to protect and stimulate American manufacturing, they may also lead to higher costs for US businesses and consumers at least in the short term, if not even for longer periods. The strategic targeting of specific sectors suggests a focused effort to address national security concerns and foster long-term economic resilience from a US-focused perspective.

For Chinese exporters, the new tariffs represent a significant challenge, particularly in the medical and clean energy sectors. However, given the relatively modest scale of the new tariffs compared to the total trade volume between the two countries, the immediate economic impact on bilateral trade may be limited.

Minor Implications on the EU as an Alternative Single Market

The US tariffs, particularly electric cars, are expected to have minimal impact on EU-China trade. An analysis from the Kiel Institute shows, that US imports only amount to 12,000 Chinese electric cars annually, making any diversion to other markets negligible, and that the EU is the main market for Chinese electric vehicles, with nearly 500,000 units sold last year. This underscores the EU's significant role and negotiating power in this market. The Institute also suggests the EU should carefully consider its stance on potential tariffs against Chinese EVs to maintain benefits from the green transformation.

Simulations by the Kiel Institute indicate that the US tariffs will lead to minor shifts in trade, with slight increases in EV imports to Canada, Mexico, and the EU.

The overall effect on global trade is expected to be minimal, as other countries will likely compensate for reduced US imports. The tariffs are anticipated to decrease all US imports from China by up to 3%.

How EAC - International Consulting Can Help

At EAC - International Consulting, we understand the complexities of international trade and its implications. Our team of experts offers strategic insights and tailored solutions to help businesses adapt to the latest tariff changes and mitigate their impact. Whether it's market entry strategies, supply chain optimization, or a tariff-proof business model transformation, EAC is here to support you every step of the way.

For more information, please contact Roland Bopp Partner at EAC USA.