India’s New EV Import Policy: A Boon for Global Manufacturers?

In 2023, premium EVs (>35 thsd USD) accounted for 2.4 thousand units and is expected to grow exponentially to 100 thsd units/annum by 2030. Currently, BMW India has the highest market share of 46% in the premium EV segment, with the company importing 5 models with a price range of 80 thsd USD to 296 thsd USD (ex-showroom).

India enforces a tiered import duty structure for electric vehicles (EVs). Completely built units (CBU) >40 thsd USD face a hefty 100% import duty, with a 70% duty for those priced below this threshold. In contrast, completely knocked down (CKD) units requiring assembly within India attract a significantly lower duty of 15%.

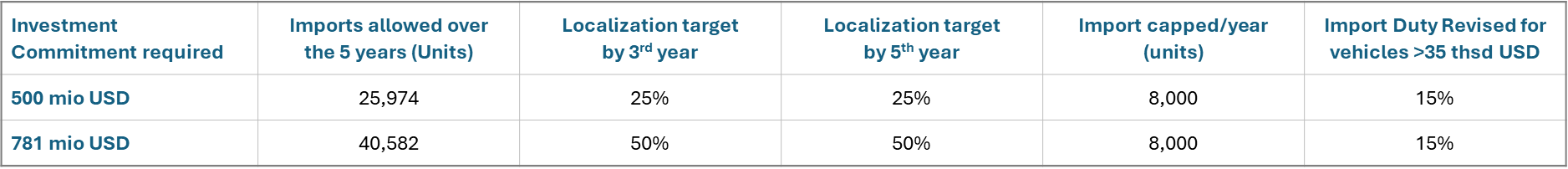

The new import policy offers reduced import duties for electric vehicles exceeding >35 thsd, however this is only applicable for companies investing in local manufacturing. The following table provides details to the eligibility criteria:

Qualifying companies also require a minimum automotive manufacturing revenue of 1.2 bln USD and global fixed-asset investments of 360 mio USD.

The policy allows all international players including Chinese manufacturers, to qualify for duty reduction post meeting the criteria, with additional approval required by countries sharing land borders with India.

The policy offers duty reductions to all international automakers, including Chinese manufacturers, who meet the criteria. However, companies from countries sharing land borders with India will continue to require additional approval.

Key questions for investment feasibility:

1.Can the market absorb 8 Thsd units/manufacturer annually within the next five years considering the factors listed below?

a)In 2023, India sold only 4 Thsd premium EVs compared to 46,000 premium cars (including gasoline-powered vehicles) across 6 manufacturers.

b) The current leader in premium EVs would need to increase sales by ~7.3X to reach sales of 8 Thsd units/

2. Is it possible to achieve a positive Net Present Value (NPV) and Internal Rate of Return (IRR) by solely focusing on the premium EV segment?

The Indian market may not be mature enough for high-volume sales of premium vehicles. To achieve desired IRR targets, manufacturers might need to:

a) Target the economy segment (higher volume) with localized production of EVs costing less than 35 Thsd EUR.

b) Increase overall sales volume to ensure investment profitability.

In conclusion, careful analysis of these factors is crucial to determining the investment feasibility of premium EV manufacturing in India. To ensure a successful strategy, consider diversifying your product portfolio beyond the premium segment and staying attuned to the evolving Indian EV market landscape. For further insights, please reach out to Abhishek Payas and EAC Partner Ketan Jadhav.